The pandemic years were a golden period for the housing market; remote work, drastically low rates, and a deluge of young, hungry American homebuyers accelerated home values, though supply shortages persisted. Accompanying this surge was also a record-high in home improvement spending, taking the remodeling market to $570 billion last year. Now, the lack of housing inventory and the Federal Reserve’s war on inflation have reversed the tide. High mortgage rates have made owning a home unattainable for a majority of homebuyers and limiting for homeowners. However, whether or not high mortgage rates will impact spending on home renovations is another question. Occam finds that while these rates have undeniably “handcuffed” homeowners and spending on major renovations continues to shrink, spending on minor renovations is stable, and growing. Average spending as well as visits per year for big-box home improvement centers such as Home Depot and Lowe’s reveal they are popular as ever, and if consumer sentiment is any indication, they should enjoy further success as they expand.

Macro Home Improvement Trends

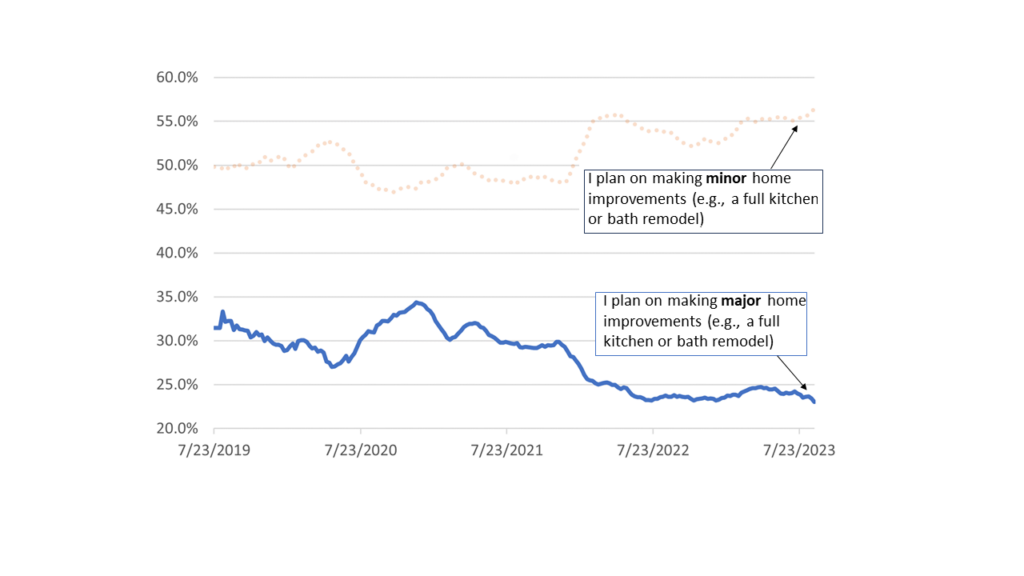

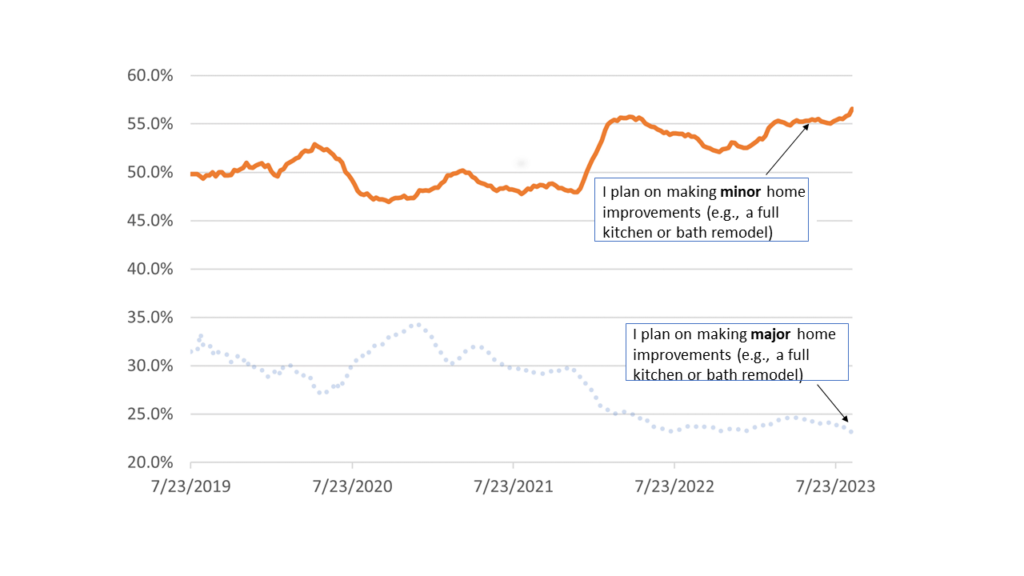

- Following the surge in major home renovations during the stay-at-home phase of the COVID-19 pandemic, occam indicates a subsequent steady decline.

Mortgage Rates and House Hunting

- We see two major reasons for the decrease in major home renovations, both linked to higher interest rates:

1) the cost of financing renovations has increased substantially.

2) reluctant to lose their current low mortgage rates, many would-be sellers are staying put, postponing the renovations often performed in preparation for selling.

Macro Home Improvement Trends

- However, occam shows the intent to undertake minor renovations is reaching a multi-year high.

Mortgage Rates and House Hunting

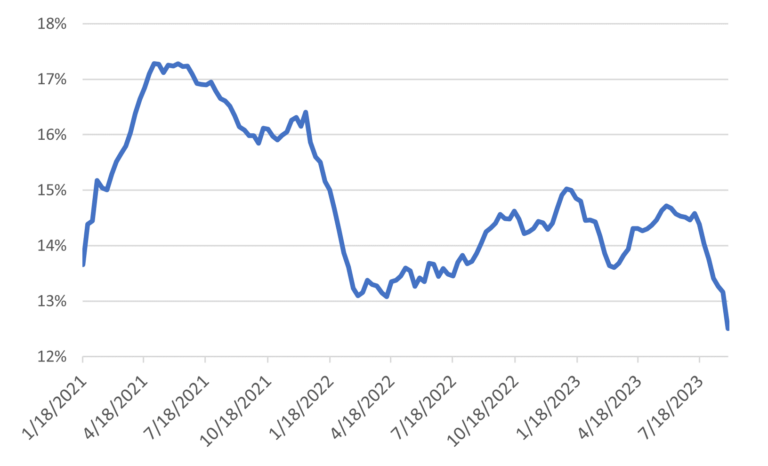

- Nearly half of those actively looking to buy a home say that current mortgage rates are preventing them from doing so.

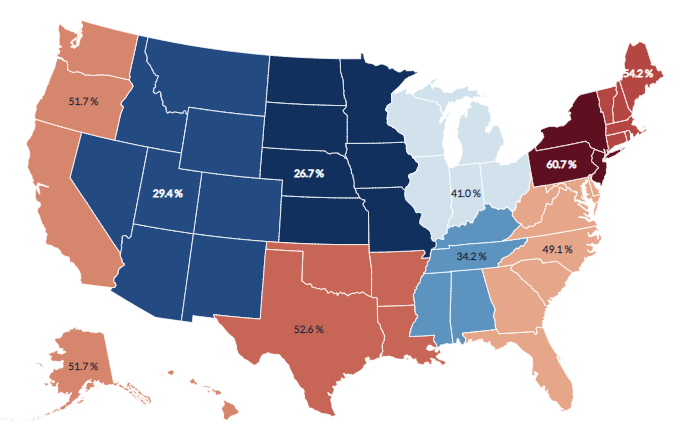

- Occam shows marked regional differences, with the greatest sensitivity to high mortgage rates along the coasts and in the West South Central (the Census division that contains Texas).

Home Depot/Lowe's Customers

- About half of Home Depot sales come from “professional customers”(contractors, handymen, tradespeople) while Lowe’s revenue is about 25% from professionals.

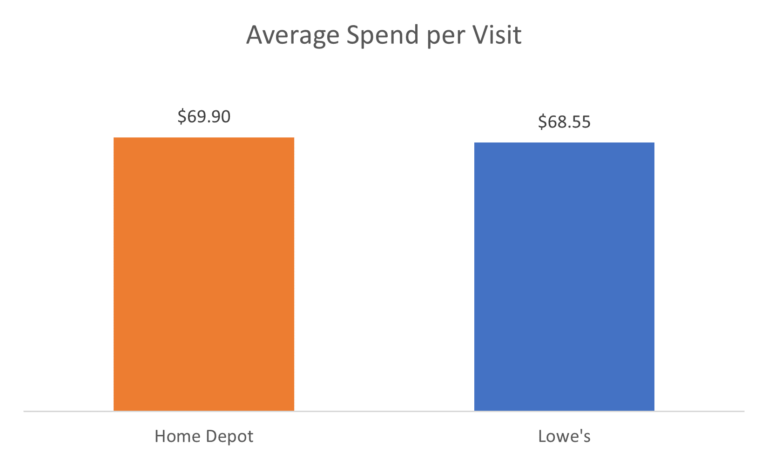

- Even with the different customer mix, occam reports that there is not a meaningful difference between average spend per visit.

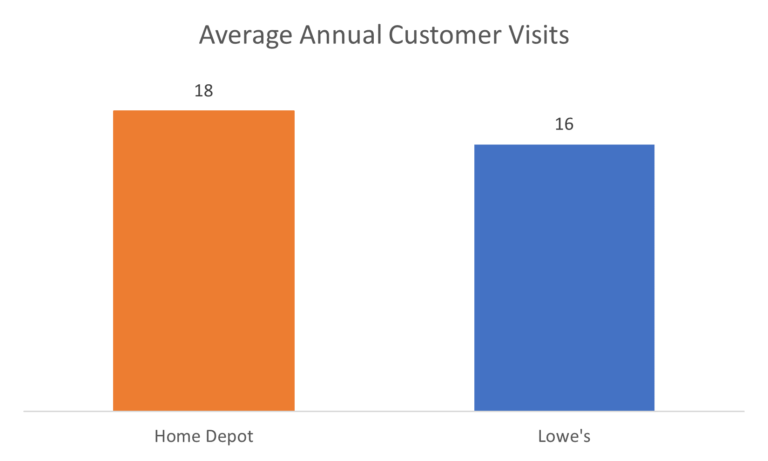

- Similarly, both retailers see an almost-equivalent level of average customer visits per year.

Big-Box Retailers NPS

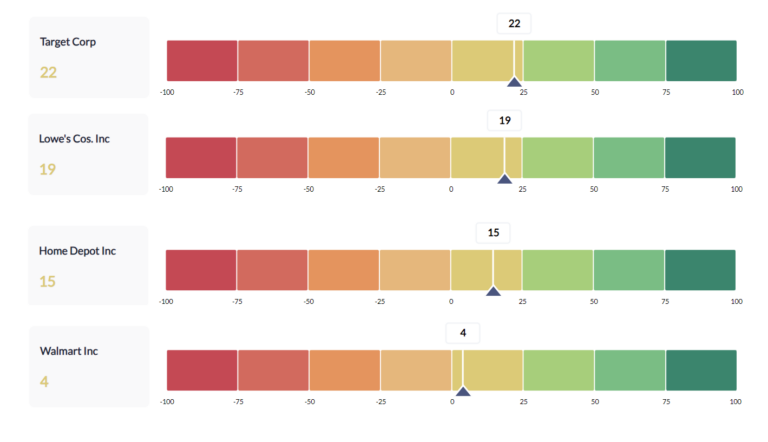

- Relatively high NPS scores indicate big-box home improvement retailers are still favored by consumers.

- Lowe’s edges out Home Depot in NPS, which might be why it remains a favorite choice of DIYers.

Source: Analysis based on occam™ proprietary AI-enhanced research platform with various data sources, including a wide range of questions asked to over 1000 respondents per day with over three years of history. Information is census-balanced and uses occam’s™ proprietary AI algorithm that ensures minimal sampling bias (<1%). Contact us for more info.

AlphaROC occam case studies are for illustrative purposes only. This material is not intended as a formal research report and should not be relied upon as a basis for making an investment decision. The firm, its employees, data vendors, and advisors may hold positions, including contrary positions, in companies discussed in these reports. It should not be assumed that any investments in securities, companies, sectors, or markets identified and described in these case studies will be profitable. Investors should consult with their advisors to determine the suitability of each investment based on their unique individual situation. Past performance is no guarantee of future results.