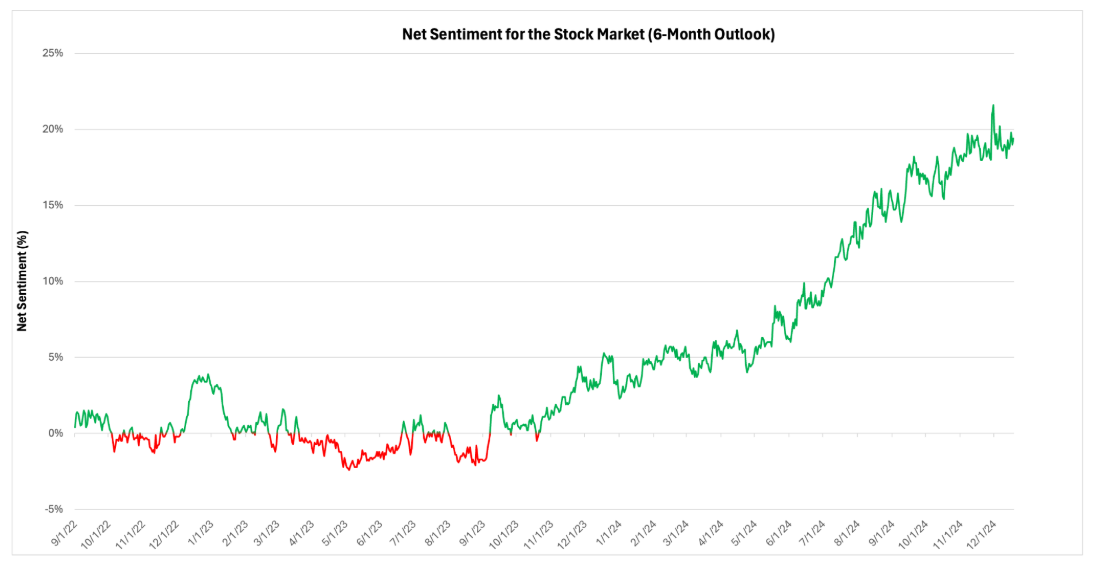

- Occam’s daily tracking of Americans’ 6-month outlook on the stock market shows that retail’s market expectations are at relatively euphoric levels.

- Net sentiment measures the difference between those expecting the market to significantly improve vs. significantly worsen. This forward-looking sentiment remains near 2-year highs just reached on November 30th.

- Occam data shows a strong correlation (R = 0.9) between forward-looking net sentiment and contemporary market trends, enabling users to identify emerging opportunities and risks in real-time.

- Subscribe today to access timely insights and stay ahead of market trends