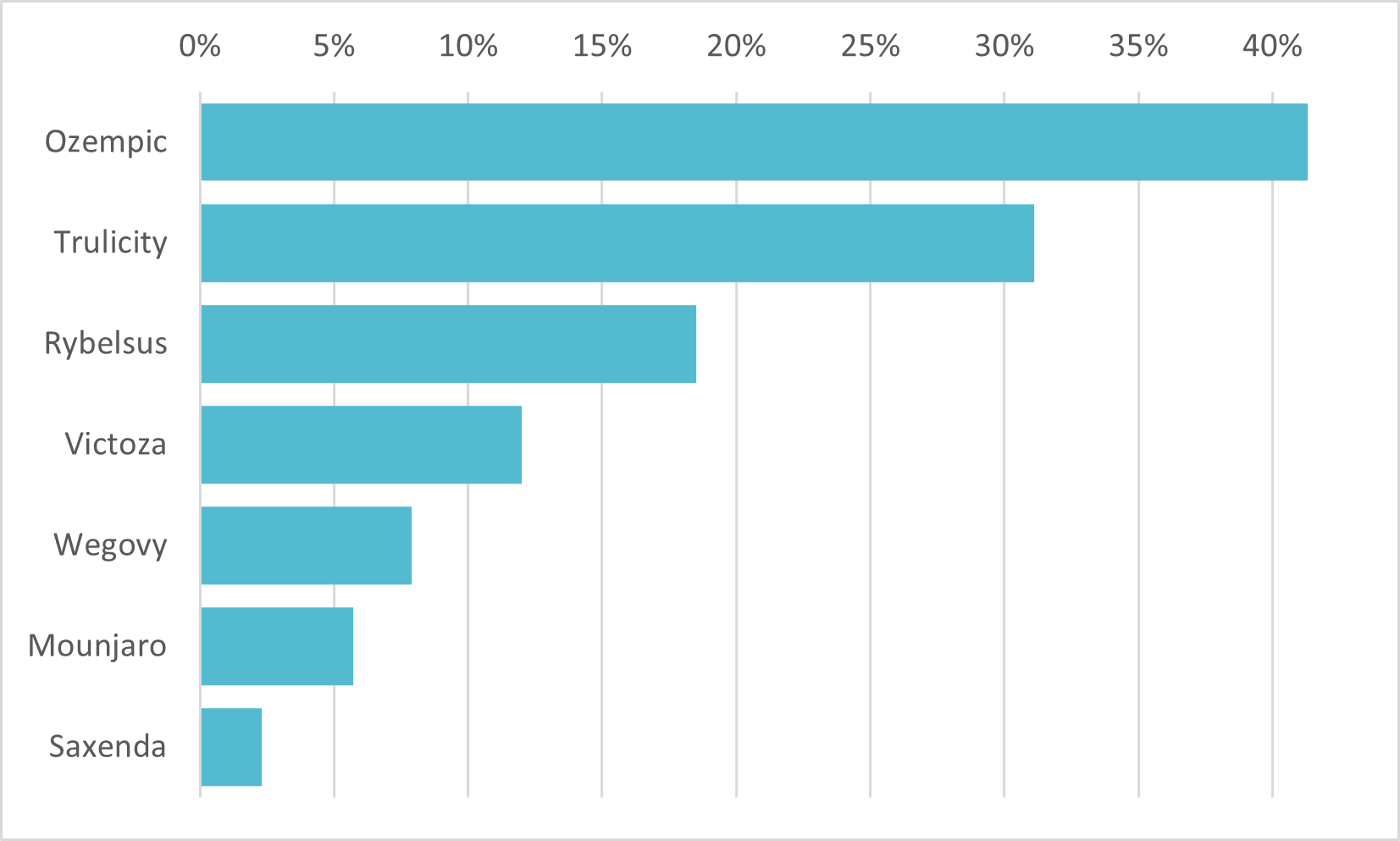

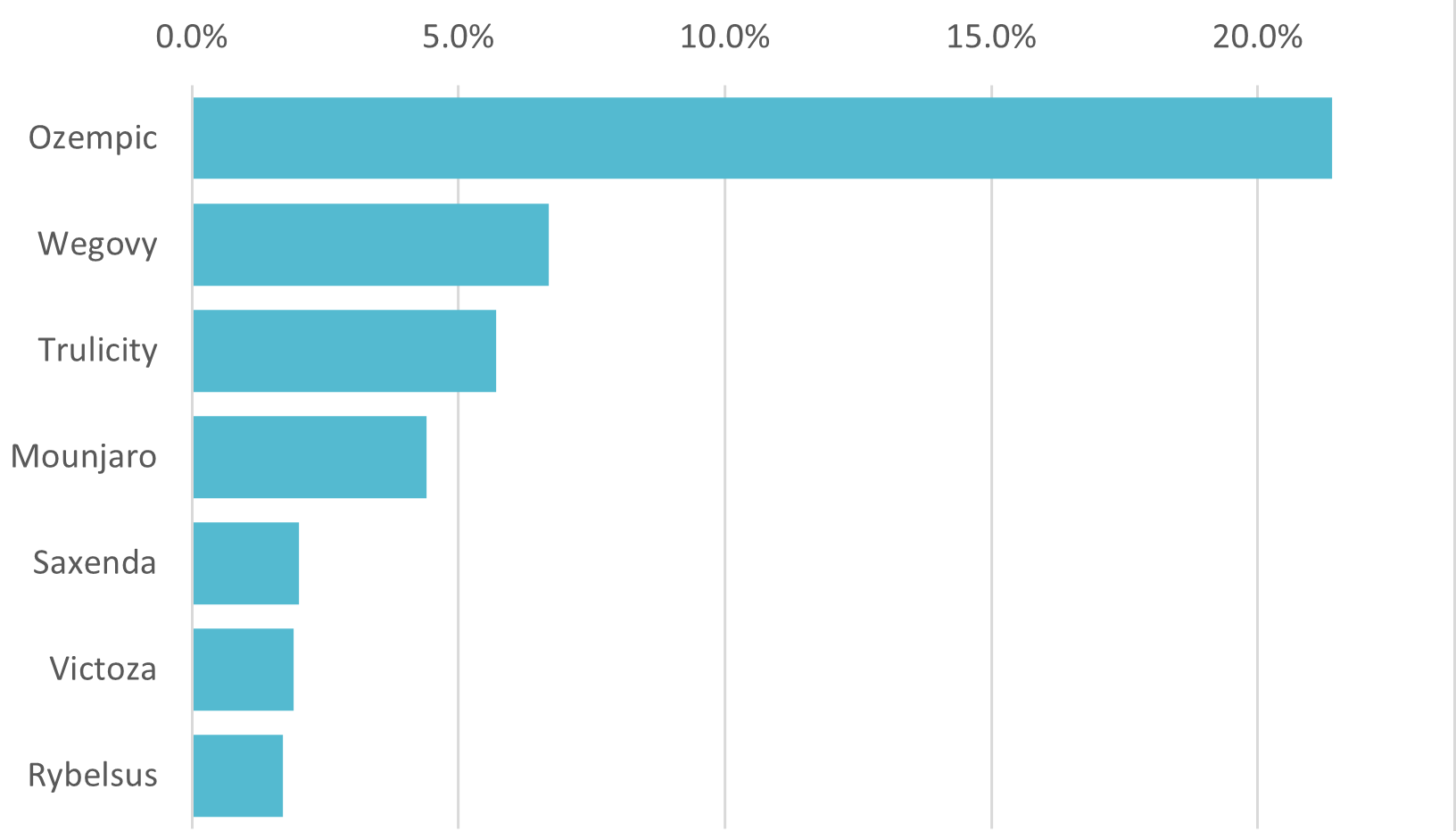

Though not yet approved by the FDA as a treatment for obesity, Ozempic’s unparalleled success for this off-label use has triggered a gold rush to capture share in the weight loss drug market, which is potentially valued at up to $150 billion. Figures 1 and 2 demonstrate that Ozempic is far outpacing its rivals in terms of consumer awareness.

The popularity of these medications among celebrities (dubbed the “worst-kept secret in Hollywood”) and significant presence on social media have played a major role in their success. However, government-sponsored insurance programs and most private insurance programs do not cover obesity treatments like Wegovy. Ozempic’s official FDA status as a medication for type 2 diabetes has made prescriptions for it much more accessible, even though the use of it for obesity is off-label.

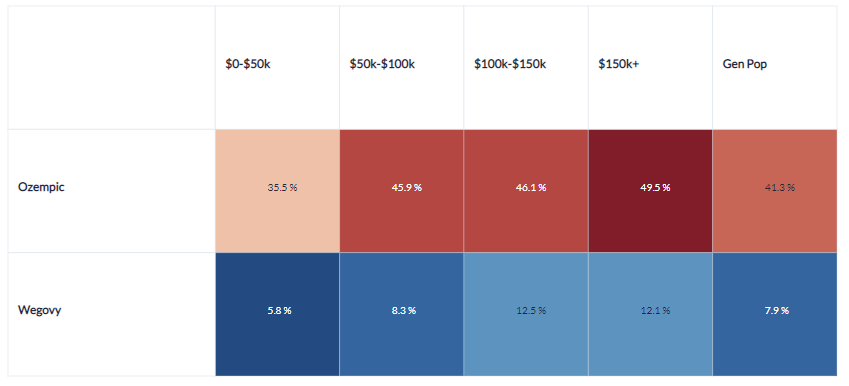

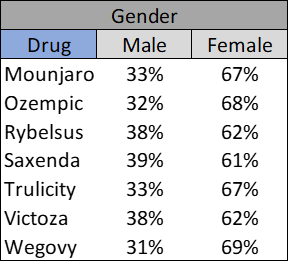

Though Ozempic and Wegovy are well recognized medications for weight loss (Ozempic for off-label use), awareness varies significantly by consumer demographic. For instance, Figure 3 reveals that individuals earning more than $100k are more familiar with Ozempic and Wegovy than those earning less than $100k. Furthermore, Figure 4 illustrates that awareness of these drugs is skewed towards women, often by a factor of two or more.

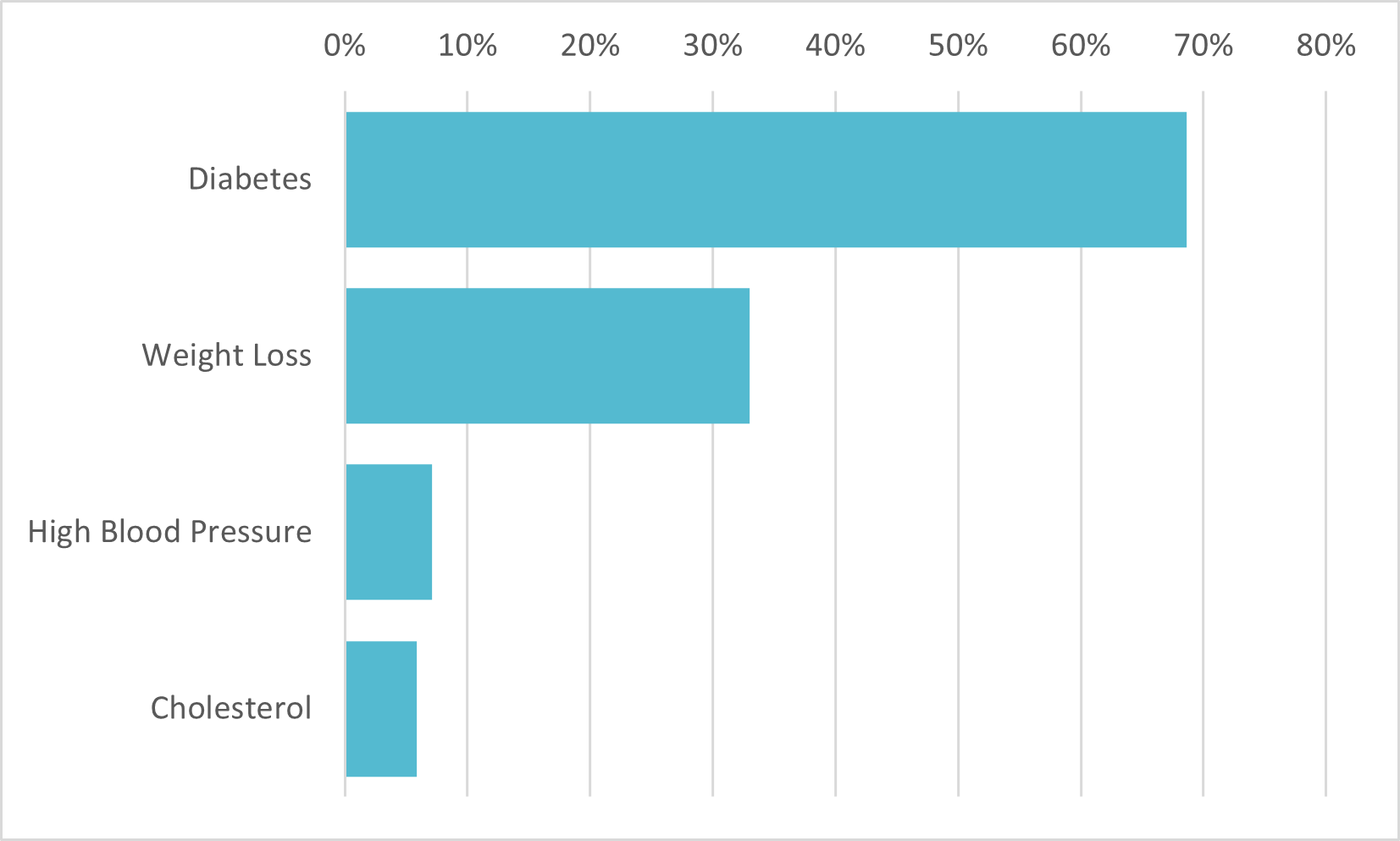

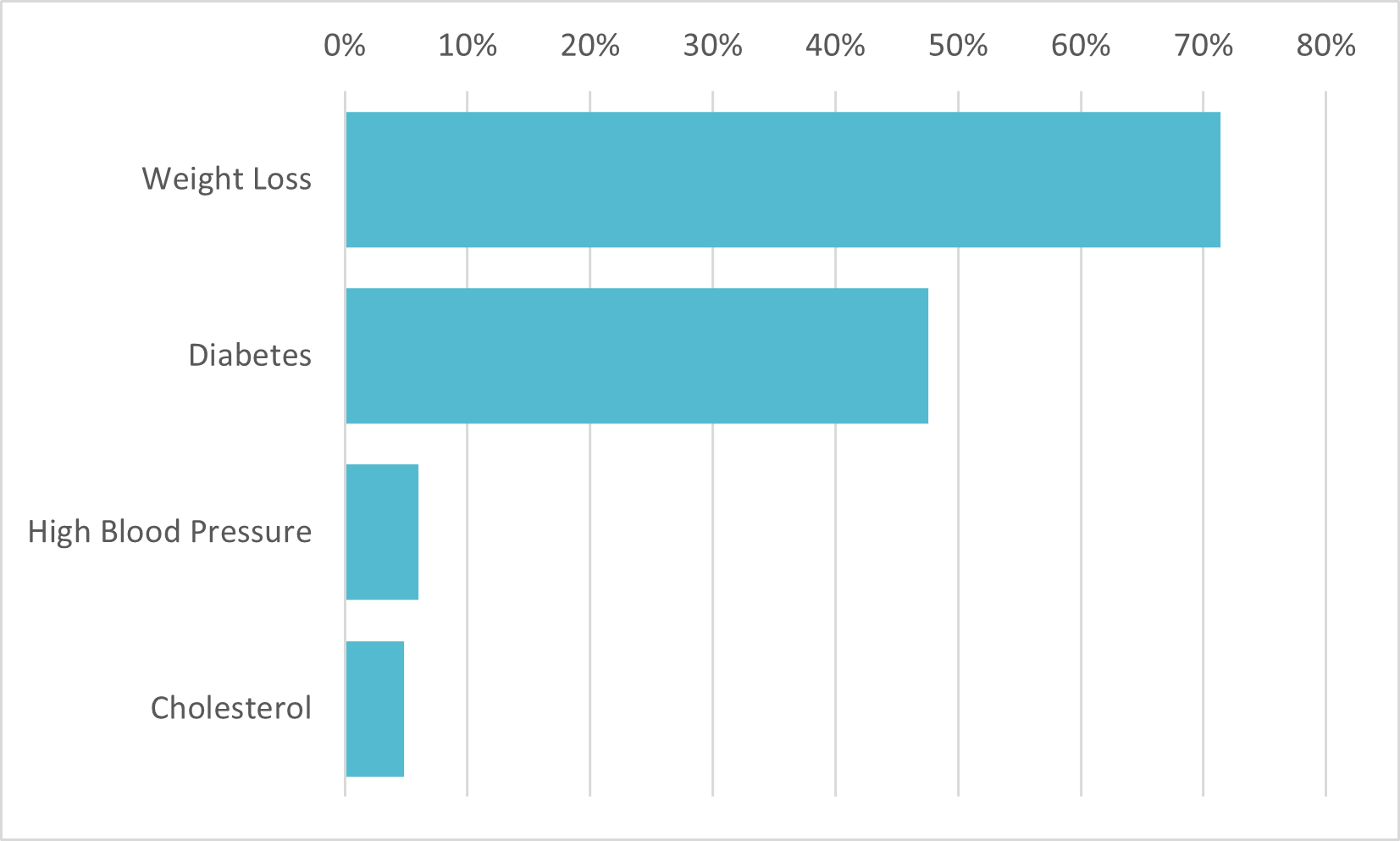

Even though the significant majority of those aware of Ozempic identify it as a diabetes medication (which is its on-label purpose), Figure 5 shows that one in three perceive Ozempic to be a weight-loss drug. Additionally, most of those aware of Wegovy (which is FDA approved for weight loss), correctly view it as a weight-loss drug (Figure 6). As mainstream knowledge of these treatments continues to expand, and as Novo Nordisk puts out similar products that it suggests “may offer even greater efficacy,” it will be interesting to see whether the company can sustain the dominant level of mindshare it currently enjoys.

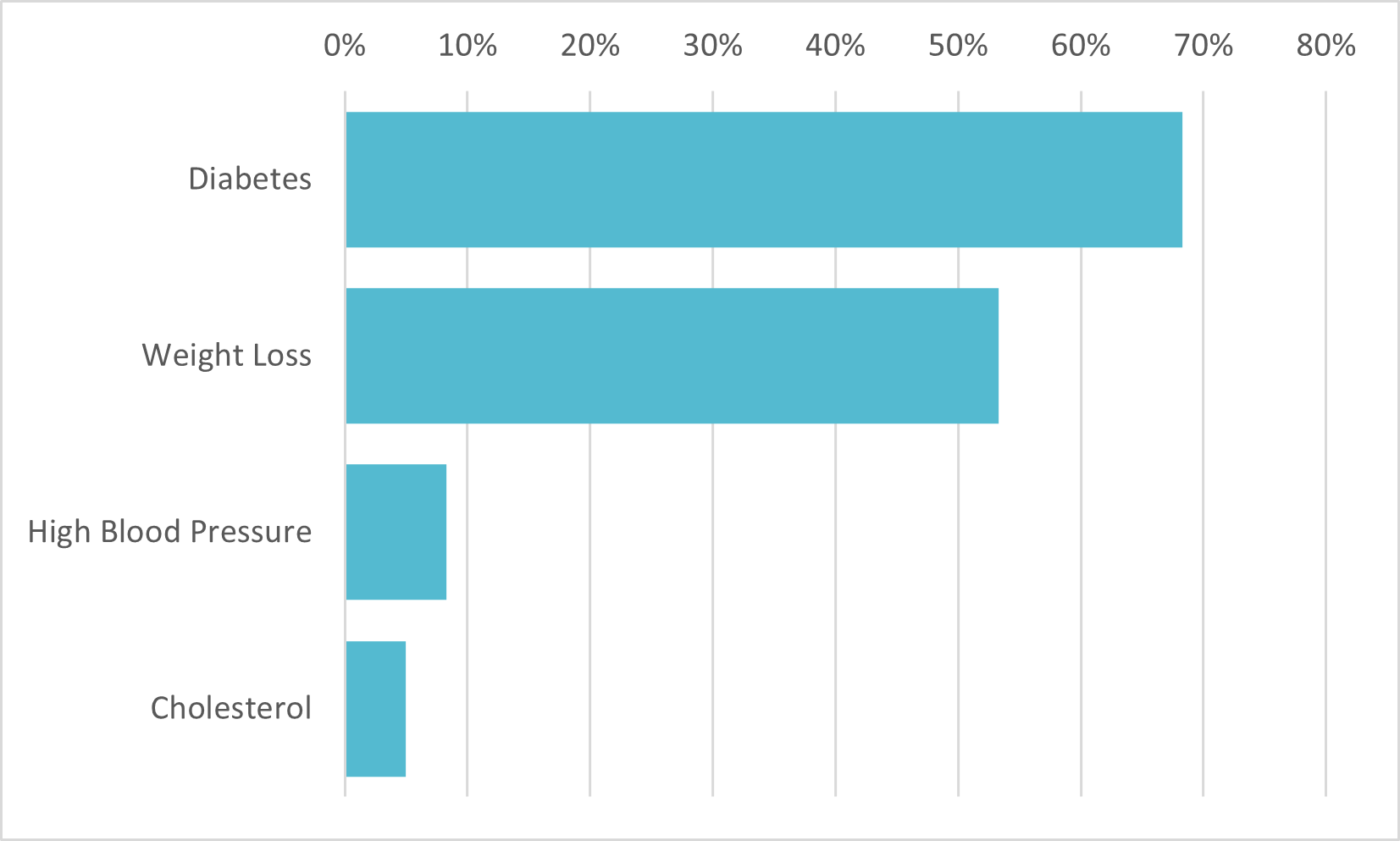

Eli Lilly’s Mounjaro is a special case. Although it is approved as a medication for type-2 diabetes (similar to Ozempic) and not as a weight loss treatment, considerable publicity from major news outlets regarding its exceptional effectiveness in combating obesity (it was dubbed the “King Kong” of weight-loss drugs, WSJ, 4/3/23) appears to have significantly influenced perception of Mounjaro as a weight-loss medication (Figure 7). The drug is currently awaiting fast-track approval from the FDA for weight management, with many anticipating approval by year’s end. Occam will continue to monitor perceptions surrounding Mounjaro and its competitors as approval nears.

Source: Analysis based on occam™ proprietary AI-enhanced research platform with various data sources, including a wide range of questions asked to over 1000 respondents per day with over three years of history. Information is census-balanced and uses occam’s™ proprietary AI algorithm that ensures minimal sampling bias (<1%). Contact us for more info.

Drug Awareness

Celebrities and social media have amplified the public trajectory of Ozempic

Weight-Loss Drugs

Ozempic dominates as the most well known weight-loss drug, despite no FDA approval

Drug Awareness

Awareness of Ozempic and Wegovy is higher among more affluent cohorts

Drug Awareness

Out of those aware of these new drugs, females represent a majority

Drug Usage

1 out of 3 of those familiar with Ozempic claim it is a weight-loss drug

Drug Usage

Consumers aware of Wegovy correctly view it as a weight-loss treatment

Drug Usage

The FDA is yet to approve Mounjaro as a weight-loss treatment, but is quickly earning that reputation among those aware of the drug

AlphaROC occam case studies are for illustrative purposes only. This material is not intended as a formal research report and should not be relied upon as a basis for making an investment decision. The firm, its employees, data vendors, and advisors may hold positions, including contrary positions, in companies discussed in these reports. It should not be assumed that any investments in securities, companies, sectors, or markets identified and described in these case studies will be profitable. Investors should consult with their advisors to determine the suitability of each investment based on their unique individual situation. Past performance is no guarantee of future results.