Ulta Beauty (ULTA) continues to trade near all time highs and has some investors wondering what have been the keys to its success. By evaluating the beauty retailer’s customer base and main competition, occam™ provides a snapshot of the beauty industry, where Ulta is getting it right, and what might be in store for the industry in the coming months.

Although forecasts about the economy have been consistently gloomy, cosmetics and luxury stocks continue to outperform the broader market. In fact, both Ulta Beauty and Sephora parent LVMH are trading near all-time highs. Ulta Beauty's broader appeal, underpinned by its broad price mix from high-end to low-end brands, and its recurring customer base have kept the company's sales strong in the face of historic inflation. Also, Ulta and Sephora's strong physical presence, bolstered significantly by their expansion into Target and Kohl's, should provide them with the expanding retail footprint necessary for upward momentum.

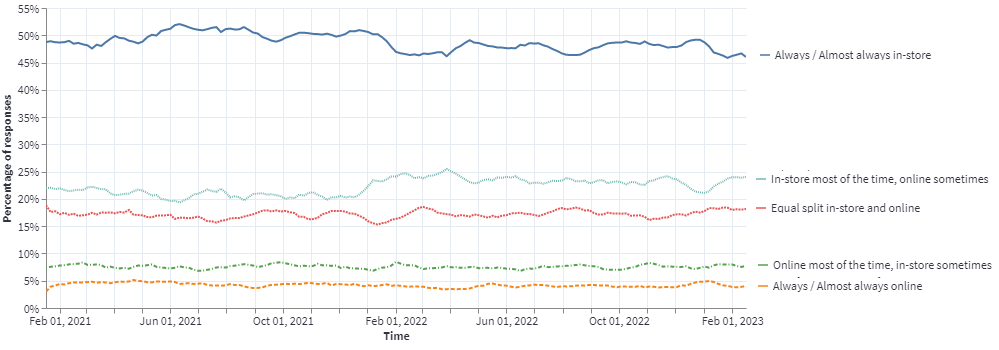

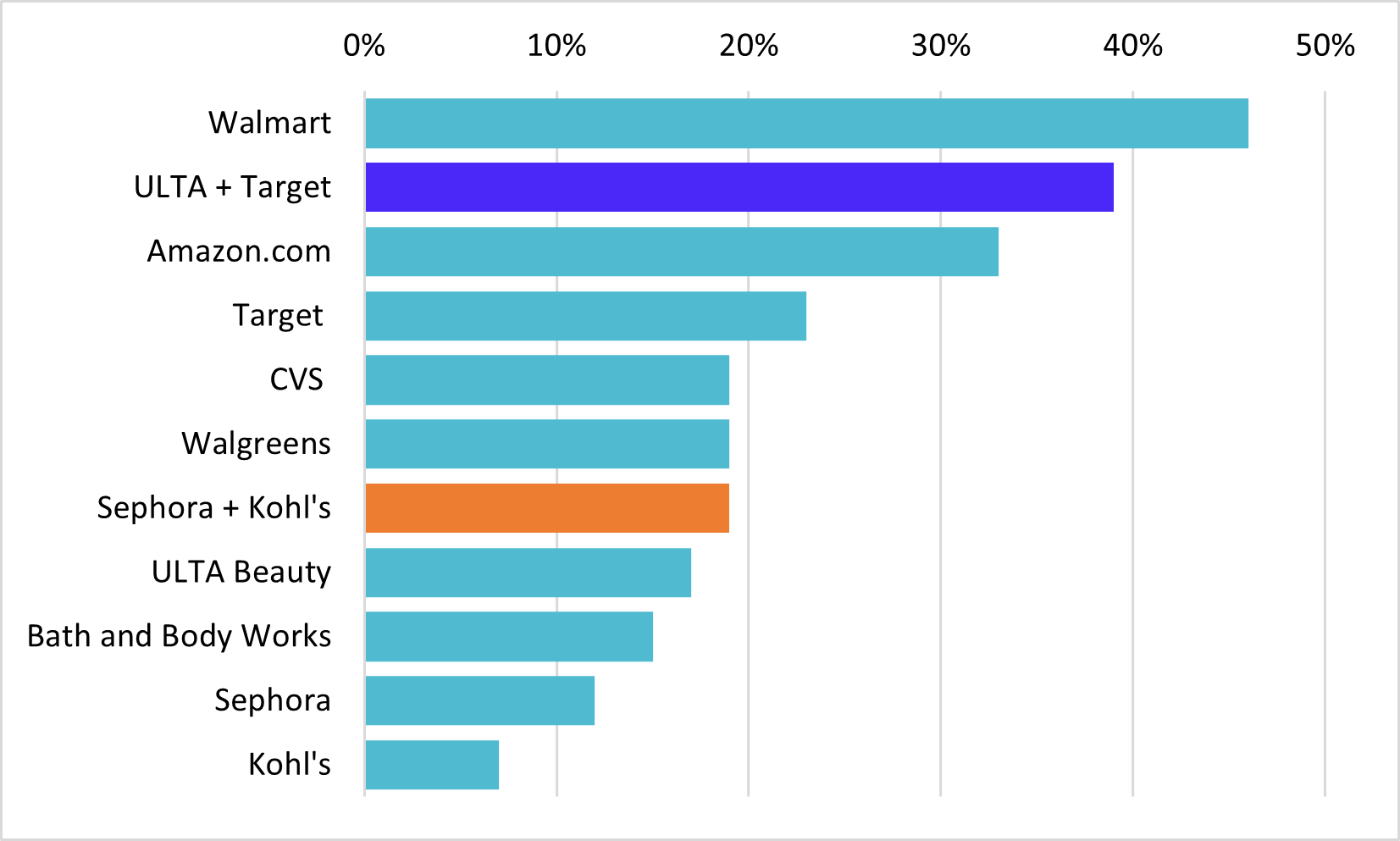

Brick-and-mortar presence is extremely important for beauty retailers; occam data has consistently found that about 50% of female shoppers always or almost always purchase their cosmetics in store vs. the 5% who shop exclusively online (Figure 1). Figure 2 demonstrates that Ulta and Sephora’s distribution capacity increases significantly when accounting for the recent Target and Kohls partnerships.

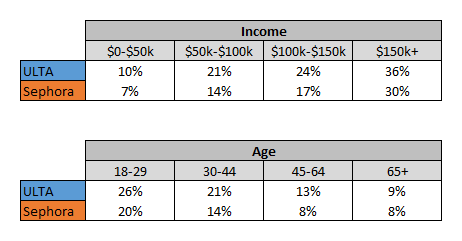

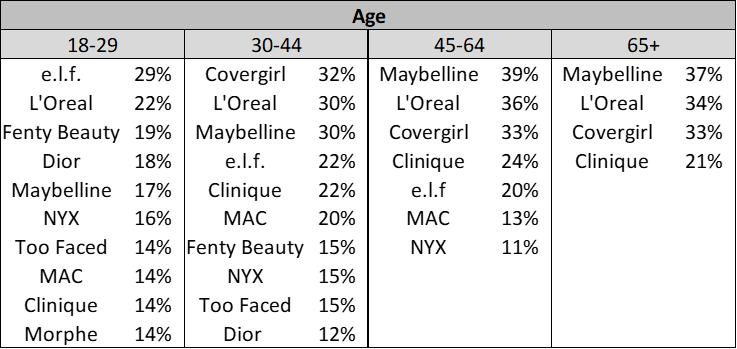

Figure 3 shows female Americans by income and age that shop at Ulta and Sephora. Ulta customers span a wide range of groups and Sephora skews towards a slightly more affluent demographic. The former’s broader appeal is understandable; occam continuously looks at consumer brand preferences and after processing cosmetics data, it reveals the top picks for age cohorts (Figure 4). Impressively, Ulta sells beauty merchandise from every brand listed (including the more high-end Dior, Fenty, and MAC).

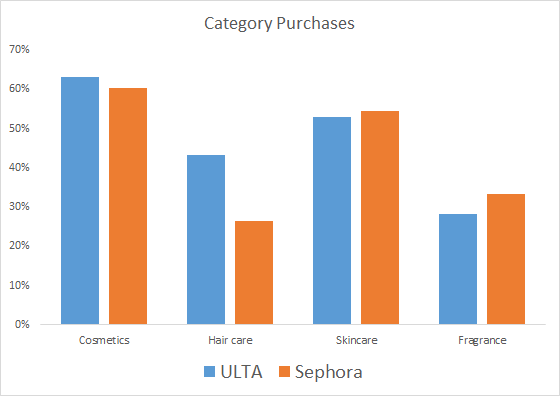

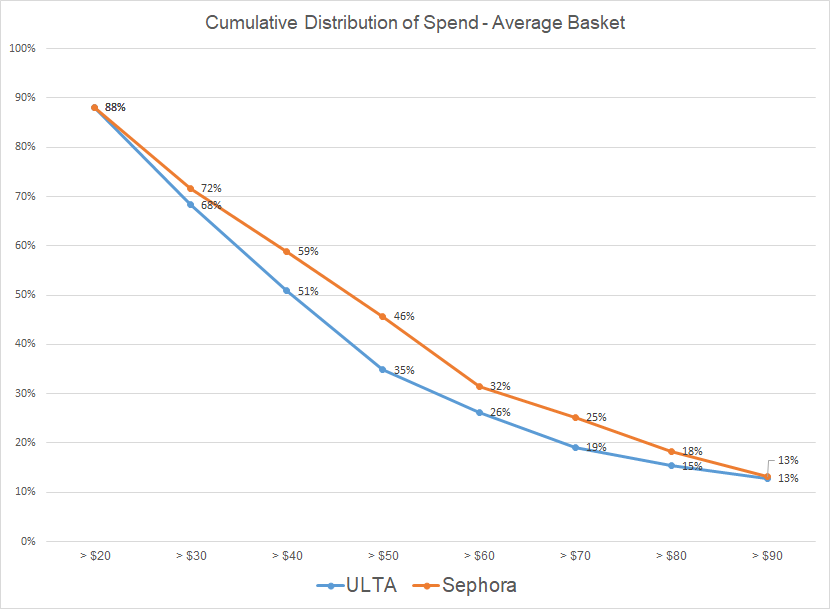

Figure 5 visualizes specific product categories for Ulta and Sephora. Though customers of both companies’ shop almost equally for cosmetics as well as skincare, they notably diverge on hair care and fragrances. For a more holistic view, occam data also examines average basket values, as seen in Figure 6. Interestingly, shoppers at both chains go home with fairly similar baskets (Sephora skews higher); half of Sephora customers spend at least $45 per visit while half of Ulta customers spend at least $40 per visit.

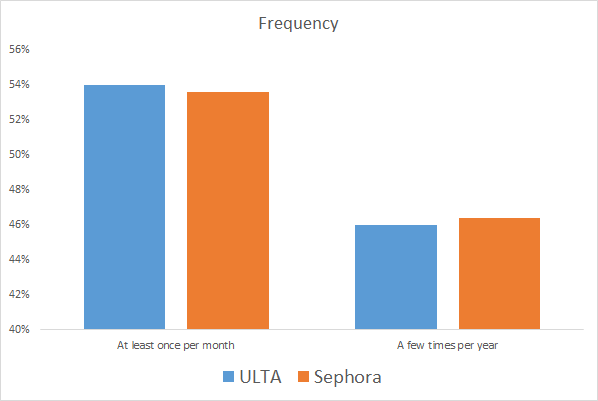

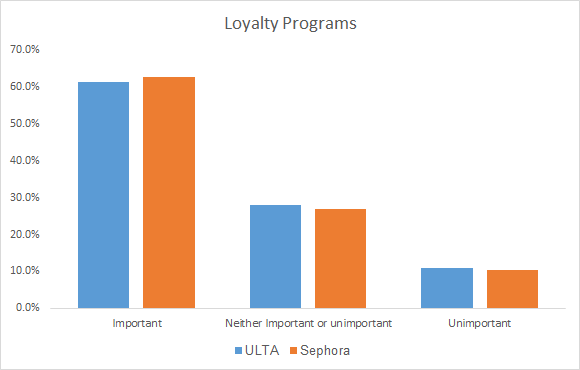

Figure 7 stands as strong testimony to the affinity shoppers have for both retailers; occam data points out that half of both Sephora and Ulta customers are buying product at least once per month. In fact, Figure 8 highlights a major factor of their popularity: Ultamate and Beauty Insider, Ulta’s and Sephora’s loyalty rewards programs. Customers overwhelmingly indicate that these incentive programs are important to their shopping experiences.

Source: Analysis based on occam™ proprietary AI-enhanced research platform with various data sources, including a wide range of questions asked to over 1000 respondents per day with over three years of history. Information is census-balanced and uses occam’s™ proprietary AI algorithm that ensures minimal sampling bias (<1%). Contact us for more info.

Shopper Behavior

1. Needful Things

Female cosmetic shoppers favor in-store shopping much more than any other channel

Retailers

2. A Friend Indeed

Ulta and Sephora's new partnerships expand their brick and mortar distribution significantly

Retailers of Choice for Female Consumers

Shopper Behavior

3. All Things Beauty

Ulta is more broadly represented across age and income spectrums while Sephora appeals to a slightly more affluent shopper

% of Female Shoppers by Income and Age that Shop at ULTA and Sephora

Brand Preference

4. Variety, the Soul of Pleasure

Younger customers buy from a broad set of brands, while older customers concentrate their purchases among a smaller set

Top Brand Preferences by Female Age Cohorts (Above 10% Consideration)

Purchases

5. Welcome to Retail Therapy

Ulta shoppers mainly spend on cosmetics, skincare, and hair care while Sephora shoppers frequent for cosmetics, skincare, and fragrances

Average Basket Value

6. Add More Lipstick and Attack

Average baskets for Sephora and Ulta are not too far apart but Sephora skews higher

Shopping Frequency

7. Quality is Always Remembered

Half of Sephora and Ulta customers are shopping at least once per month

Loyalty Programs

8. Irresistible For the Rest of Your Life

Ulta and Sephora's rewards programs have been crucial to customer retention

AlphaROC occam case studies are for illustrative purposes only. This material is not intended as a formal research report and should not be relied upon as a basis for making an investment decision. The firm, its employees, data vendors, and advisors may hold positions, including contrary positions, in companies discussed in these reports. It should not be assumed that any investments in securities, companies, sectors, or markets identified and described in these case studies will be profitable. Investors should consult with their advisors to determine the suitability of each investment based on their unique individual situation. Past performance is no guarantee of future results.