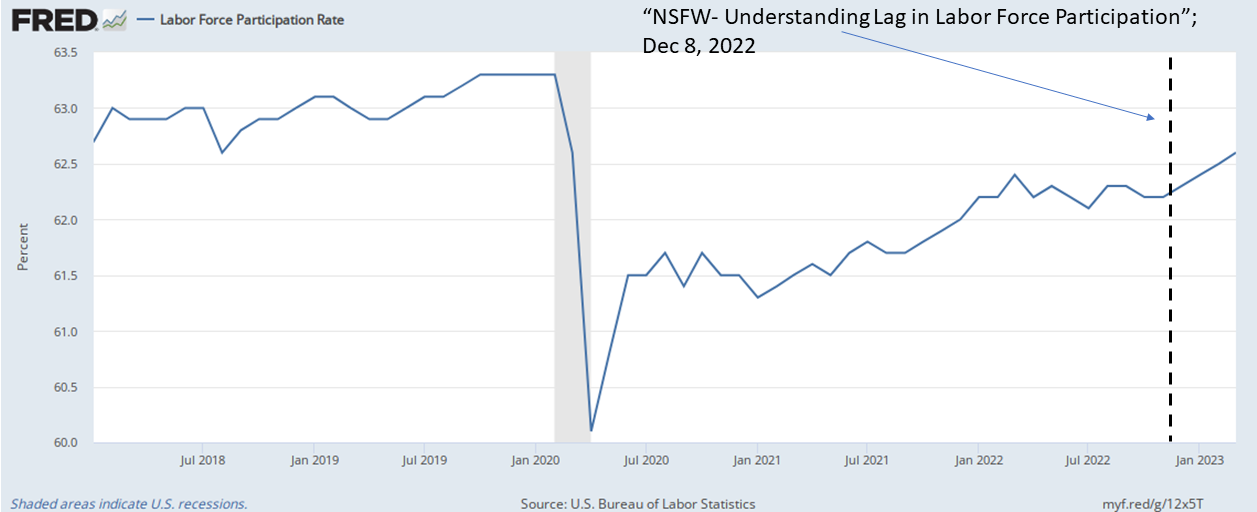

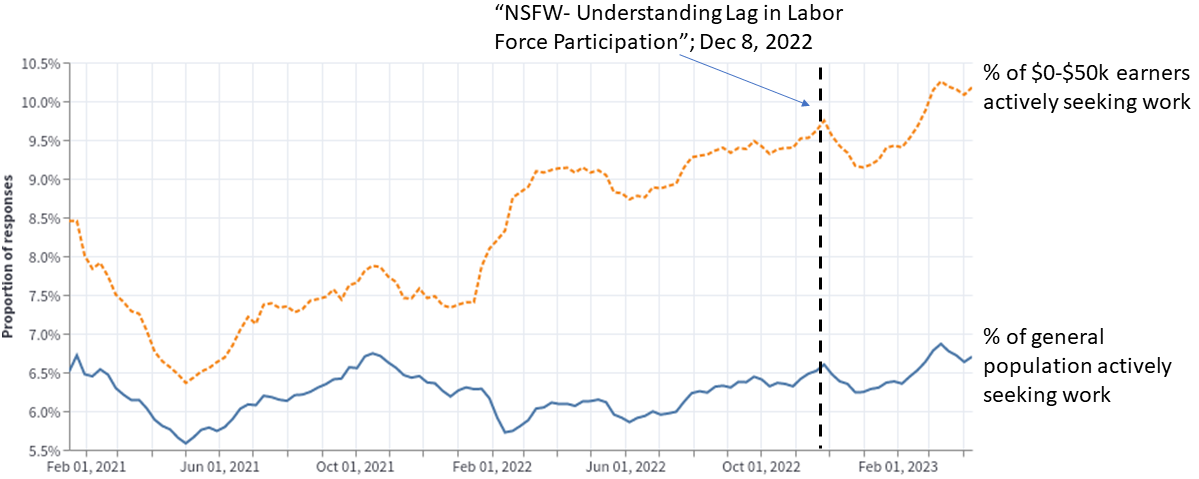

As we noted in the introduction, occam’s “looking for work” factor predicted the significant rise in the Labor Force Participation Rate we’ve seen in recent months (Figure 1). In 2023, the continued upward trajectory of the fraction that are “looking for work” should, once again, serve as a leading indicator for additional increases in the labor force participation rate, which, in turn, should serve to blunt inflation wage pressures. Importantly, as shown in Figure 2, the cohort of lower-wage workers ($0-50k incomes) is showing a notable and growing interest in returning to work. Given that companies from the hospitality industry to the medical industry (hospitals / nursing homes) are still struggling to hire and retain entry level workers, it’s encouraging to see a rising fraction of this cohort intending to join the workforce.

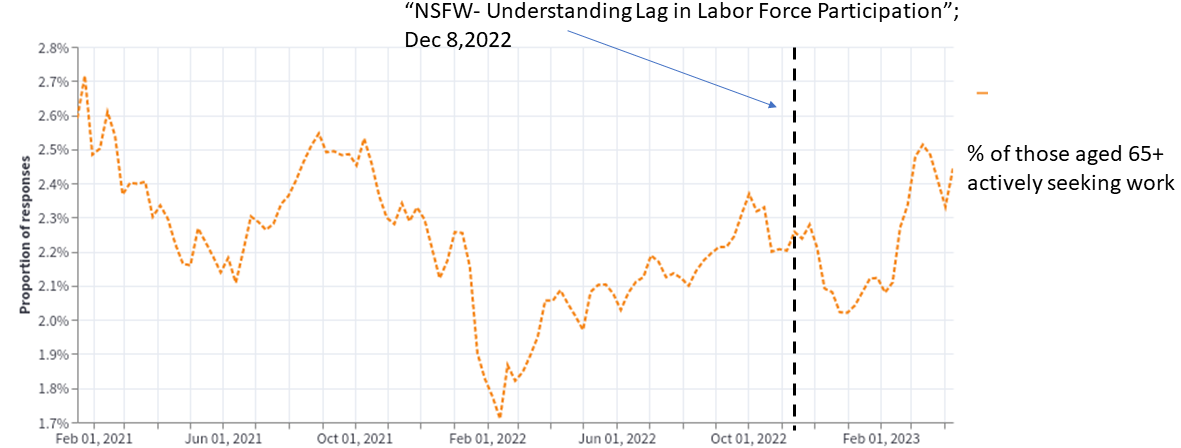

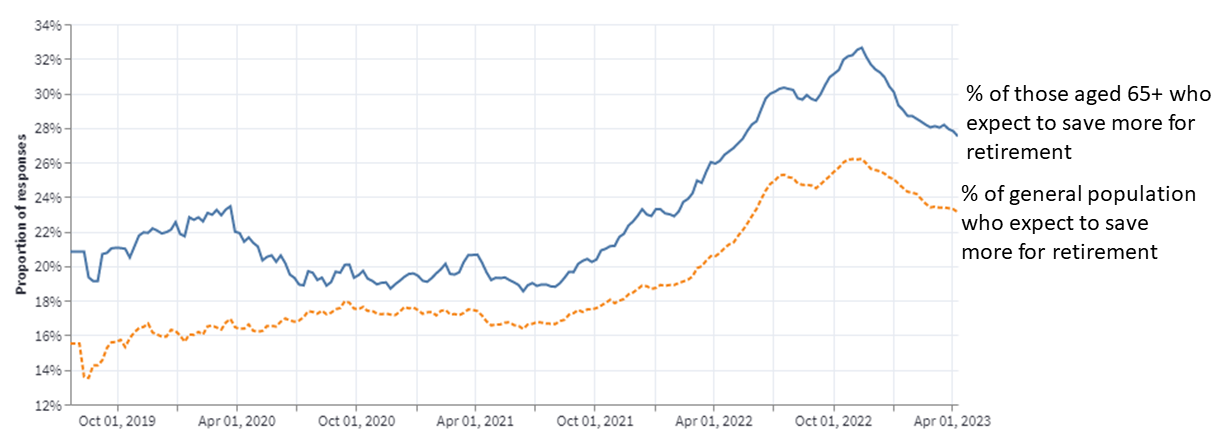

During the pandemic, some believed that many older workers (65+) were permanently discouraged from returning to the workforce. occam data suggests, however, that older workers are in fact increasingly returning to work. Figure 3 shows that during most of 2022, the 65+ cohort showed a rising interest to re-enter the workforce, and that this “un-retiring” trend has continued in 2023 unabated (Figure 3), only pausing for a seasonal lull at the end of 2022. What has driven this interest in working again? Occam data shows older Americans are feeling the need to contribute more to their retirement nest eggs (Figure 4). We also find it quite notable that interest in rejoining the workforce bottomed in early 2022 shortly after the stock market peaked. As the market subsequently sold off, interest among the 65+ cohort in rejoining the workforce grew steadily.

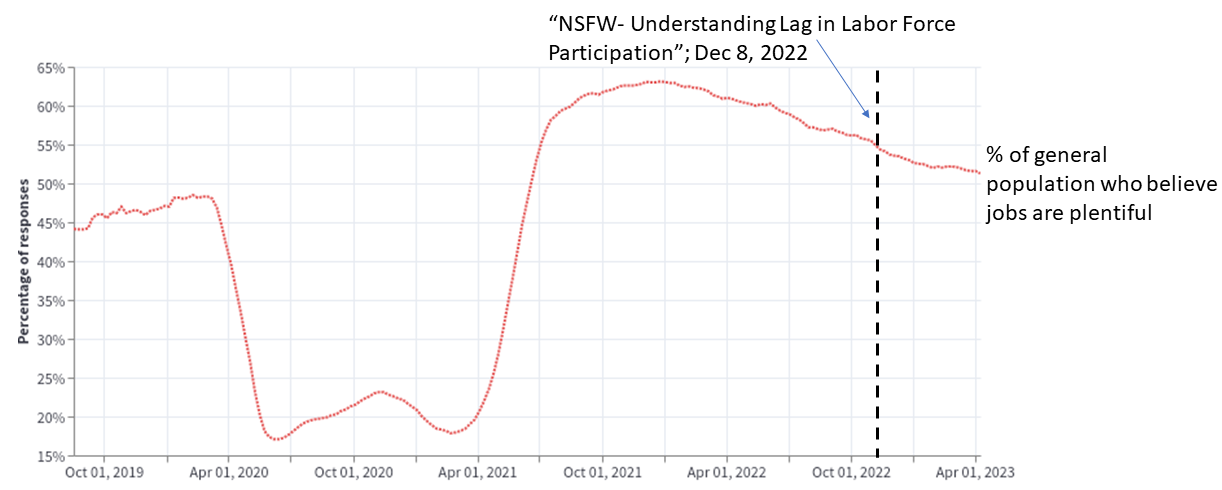

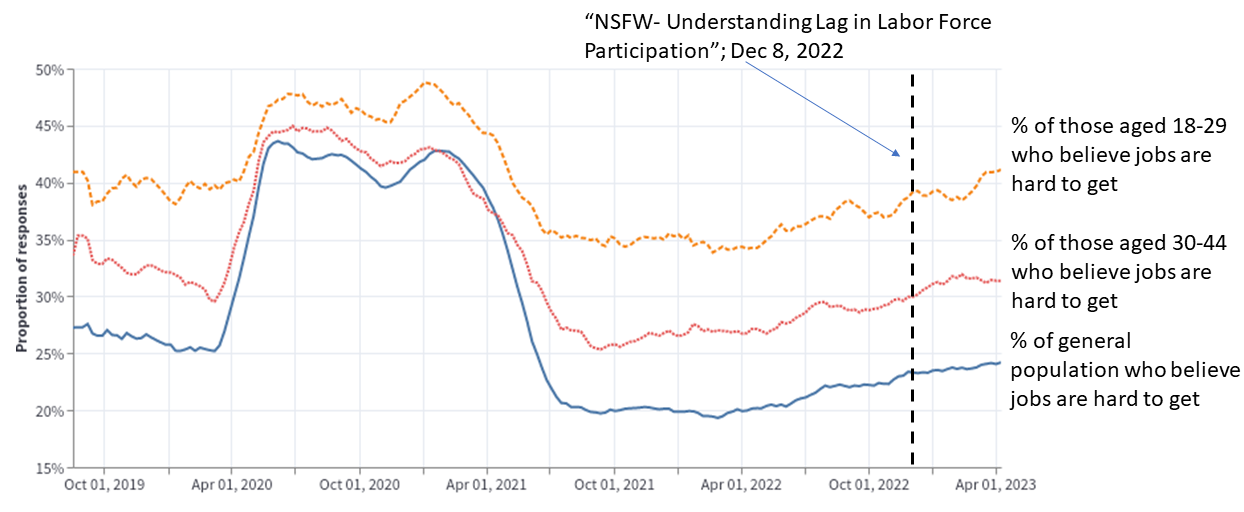

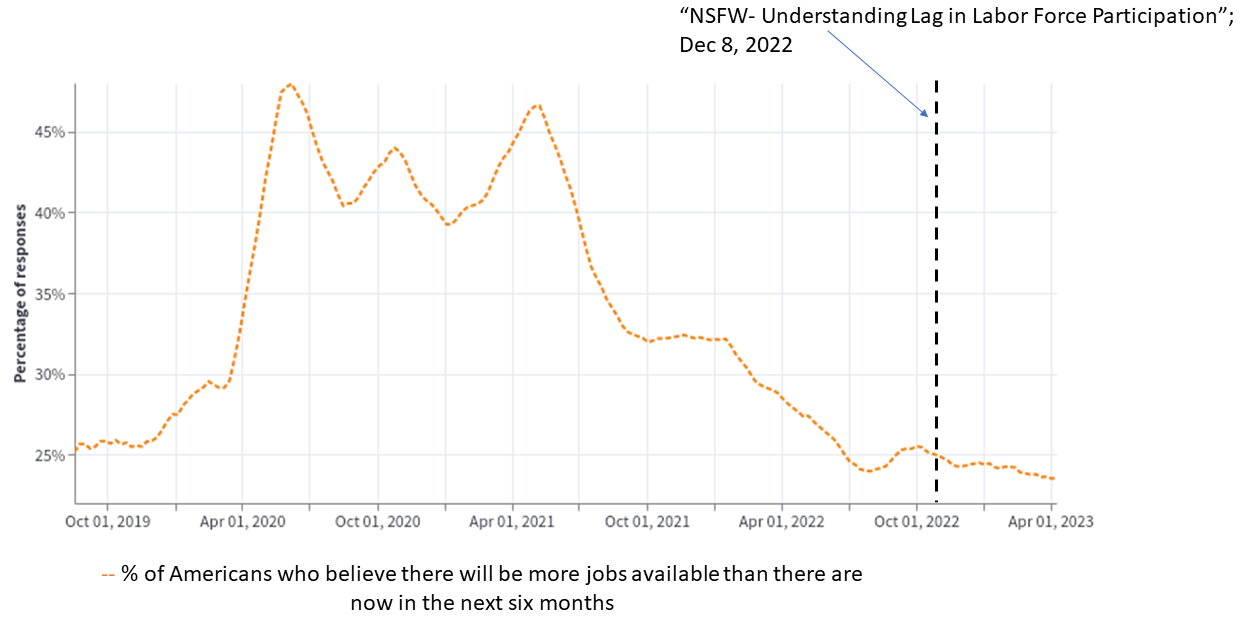

Figures 5, 6, and 7 illustrate trends in labor market sentiment. Each of these figures highlights an increasing level of pessimism about future job prospects, suggesting that the balance of power is shifting away from workers and back in favor of employers. The view that “jobs are plentiful” (Figure 5) formed a broad peak in late 2021 and early 2022 but has steadily declined from there to nearly pre-COVID levels. Figure 6 shows that while the 18-29 cohort remains the age demographic most worried about finding a job, negative sentiment is also rising in the workhorse 30-44 age group. Finally, Figure 7 shows a concerning trend: when asked about future labor market conditions, a declining percentage of respondents expect more jobs to be available in six months. In fact, this labor market sentiment metric has declined to pre-COVID levels, suggesting the labor market has finally come full circle. With the unemployment rate sitting near record lows but labor market sentiment in decline, occam data suggests to us that the unemployment rate is poised to rise from here.

Source: Analysis based on occam™ proprietary AI-enhanced research platform with various data sources, including a wide range of questions asked to over 1000 respondents per day with over three years of history. Information is census-balanced and uses occam’s™ proprietary AI algorithm that ensures minimal sampling bias (<1%). Contact us for more info.

Labor Force Participation

1. Work All Night On a Drink of Rum

Labor force participation remains below pre-Covid levels, but is steadily increasing

Unemployed Workers

2. Without Labor, Nothing Propsers

Low-wage workers are returning to the workforce just when employers need them to

Unemployed Workers

3. Not the Years in Your Life, But the Life in Your Years

Older workers are apparently "unretiring" as the year unfolds

Retirement Savings

4. If You Don't Mind, It Doesn't Matter

Older cohorts are keen on protecting their nest eggs, but their ability to save has slowed

Job Market Sentiment

5. Best Way to Appreciate a Job is Imagine Yourself Without One

Worker optimism about available jobs remains in decline

Job Market Sentiment

6. Buddy, You're a Young Man, Hard Man

Younger cohorts remain the most pessimistic regarding their prospects in the job market

Job Market Sentiment

7. Difficulty in Every Opportunity

Job market growth expectations have fallen below pre-pandemic levels

AlphaROC occam case studies are for illustrative purposes only. This material is not intended as a formal research report and should not be relied upon as a basis for making an investment decision. The firm, its employees, data vendors, and advisors may hold positions, including contrary positions, in companies discussed in these reports. It should not be assumed that any investments in securities, companies, sectors, or markets identified and described in these case studies will be profitable. Investors should consult with their advisors to determine the suitability of each investment based on their unique individual situation. Past performance is no guarantee of future results.